30+ Treasury Direct Bond Calculator

With a Series I savings bond you wait to get all the money until you cash in the bond. Therefore people may wonder which they should buy.

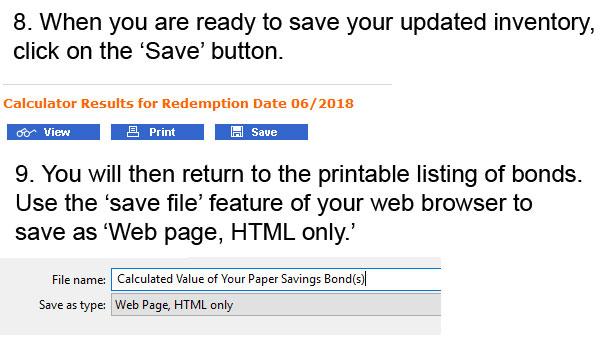

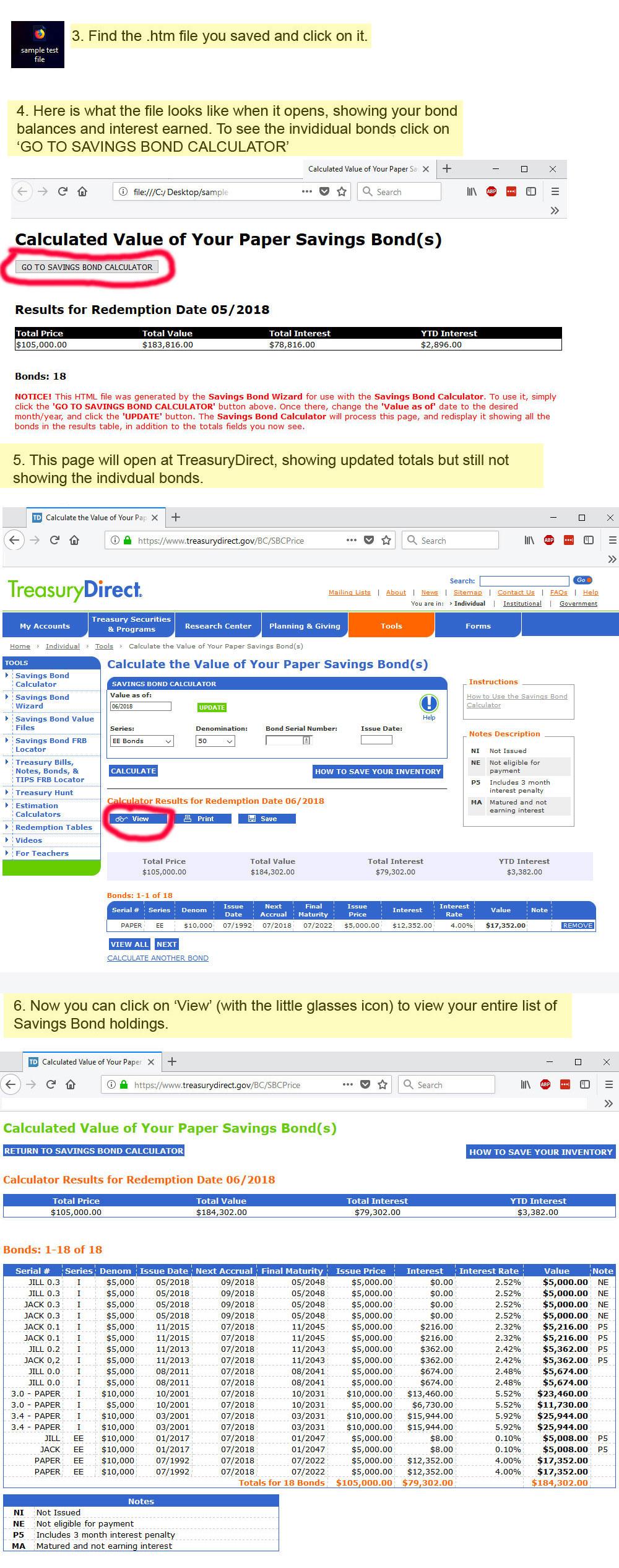

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

2023 GMC Sierra prices up start at 38995 for Sierra Pro Regular Cab.

. You must submit the paper bond to cash it. With a Series I savings bond you wait to get all the money until you cash in the bond. For example a 91 day Treasury bill of 100- face value may be issued at say 9820 that is at a discount of say 180 and would be redeemed at the face value of 100-.

For savings bonds issued November 1 2022 to April 30 2023. You must submit the paper bond to cash it. You can buy any amount up to 5000 in 50 increments.

When rates were low this double-in-value guarantee made the EE Bond a good deal if you were okay holding the EE Bond for 20 years. Can I cash it in before 30 years. About Treasury Marketable Securities Treasury Bills Treasury Bonds Treasury Notes TIPS Floating Rate Notes.

See Cash in redeem an EE or I savings bond. Can I cash it in before 30 years. With a Series I savings bond you wait to get all the money until you cash in the bond.

Treasury Seeking Comments on State and Local Government Series SLGS. If we cash your paper savings bond we mail you the 1099-INT the following January. Series I Savings Bonds.

If a bank cashes your savings bond they are responsible for getting you a 1099-INT. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. For bonds you buy November 1 2022 to April 30 2023 210 689 How do the bonds earn interest.

After purchase interest payments are paid every six months until final maturity when the principal is paid. Treasury Bonds T-Bonds are similar to treasury notes though their maturity is always more than ten years. Savings Bond Calculator Were Here to Help.

With a Series EE bond you wait to get all the money until you cash in the bond. The euro is divided into 100 cents. The interest rate is determined at the time of auction.

They may give or mail you the 1099-INT as soon as you cash the bond or they may wait until the following January. They are sold in denominations of 1000 with a maximum purchase allowance. Eastern Time SLGS 8 am.

The rate is based on market rates that have been adjusted to account for the value of components unique to savings bonds. Long ago I had purchased I bonds electronically with a faceprincipalissue value of 10000 and in 2020 I redeemed 2000 total proceeds. The interest is not taxable on the state level but is taxed by the federal government.

Savings Bonds Buy a Bond Gift a Savings Bond Cash In a Bond Savings Bond Value Calculator Manage Bonds Forms for Savings Bonds. You can buy any amount up to 5000 in 50 increments. Treasury notes pay interest every six months until they reach maturity.

See Cash in redeem an EE or I savings bond. The Secretary of the Treasury or the Secretarys designee determines the fixed rate. Each savings bond earns interest for you in your TreasuryDirect account until you tell us to cash the bond or until it reaches the end of its 30-year interest-earning life.

We pay automatically when the bond matures if you havent cashed it before then. Instead they are issued at a discount and redeemed at the face value at maturity. Can I cash it in before 30 years.

We pay automatically when the bond matures if you havent cashed it before then. Freedom of Information Act. We pay automatically when the bond matures if you havent cashed it before then.

These include the early redemption put option tax deferral feature deferred purchase feature and Treasurys administrative costs. See Cash in redeem an EE or I savings bond. Invest in high-rated bonds from as low as Rs.

It may change after that for. Can I cash it in before 30 years. Treasury bills are zero coupon securities and pay no interest.

The only way to get a paper savings bond now is to use your IRS tax refund. Savings Bonds Buy a Bond Gift a Savings Bond Cash In a Bond Savings Bond Value Calculator Manage Bonds Forms for Savings Bonds. To 430 pm Connect With Us.

You must submit the paper bond to cash it. 2022 to April 30 2023. We pay automatically when the bond matures if you havent cashed it before then.

You must submit the paper bond to cash it. We pay automatically when the bond matures if you havent cashed it before then. The currency is also used officially by the institutions of the European Union by four European.

EE bonds you buy now have a fixed interest rate that you know when you buy the bond. Both Treasury-Inflation Protection Securities TIPS and Series I Savings Bonds adjust for inflation. As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows.

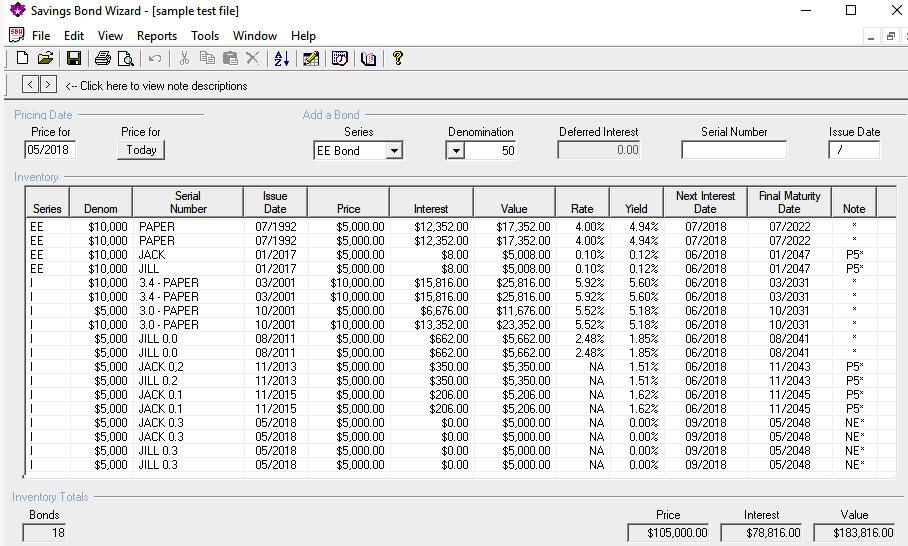

Can I cash it in before 30 years. In the next month we will not reissue it. At that time I was able to prove that breakdown by using the paper bond calculator as follows.

Buying paper Series I savings bonds. EUR is the official currency of 19 out of the 27 member states of the European Union EU. This group of states is known as the eurozone or officially the euro area and includes about 340 million citizens as of 2019.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. However Treasury yields are much higher these days. The only way to get a paper savings bond now is to use your IRS tax refund.

Buying paper Series I savings bonds. See Cash in redeem an EE or I savings bond. Savings Bonds Buy a Bond Gift a Savings Bond Cash In a Bond Savings Bond Value Calculator Manage Bonds Forms for Savings Bonds.

You must submit the paper bond to cash it. Microsoft describes the CMAs concerns as misplaced and says that. Treasury Bonds - not to be confused with savings bonds - are a type of long-term fixed-principal Treasury marketable security of 10 to 30 years.

Invest as low as 10000 and earn better returns than FD. See Cash in redeem an EE or I savings bond. We also do not reissue old bonds that have stopped earning interest.

My Treasury Direct account broke out principal and interest of 1550 and 450 respectively. That rate remains the same for at least the first 20 years. Find Invest in bonds issued by top corporates PSU Banks NBFCs and much more.

Series EE and I bonds mature 30 years from their issue date. Treasury Retail Securities. With a Series EE bond you wait to get all the money until you cash in the bond.

On the week of November 5th the average 30-year fixed-rate fell to 278. The estimated yields of the 20-year Treasury bond have been in the range of 400 to 460 in the last month according to the Daily Treasury Par Yield Curve. 2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and.

Each savings bond earns interest for you in your TreasuryDirect account until you tell us to cash the bond or until it reaches the end of its 30-year interest-earning life.

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Treasury Inflation Protected Securities

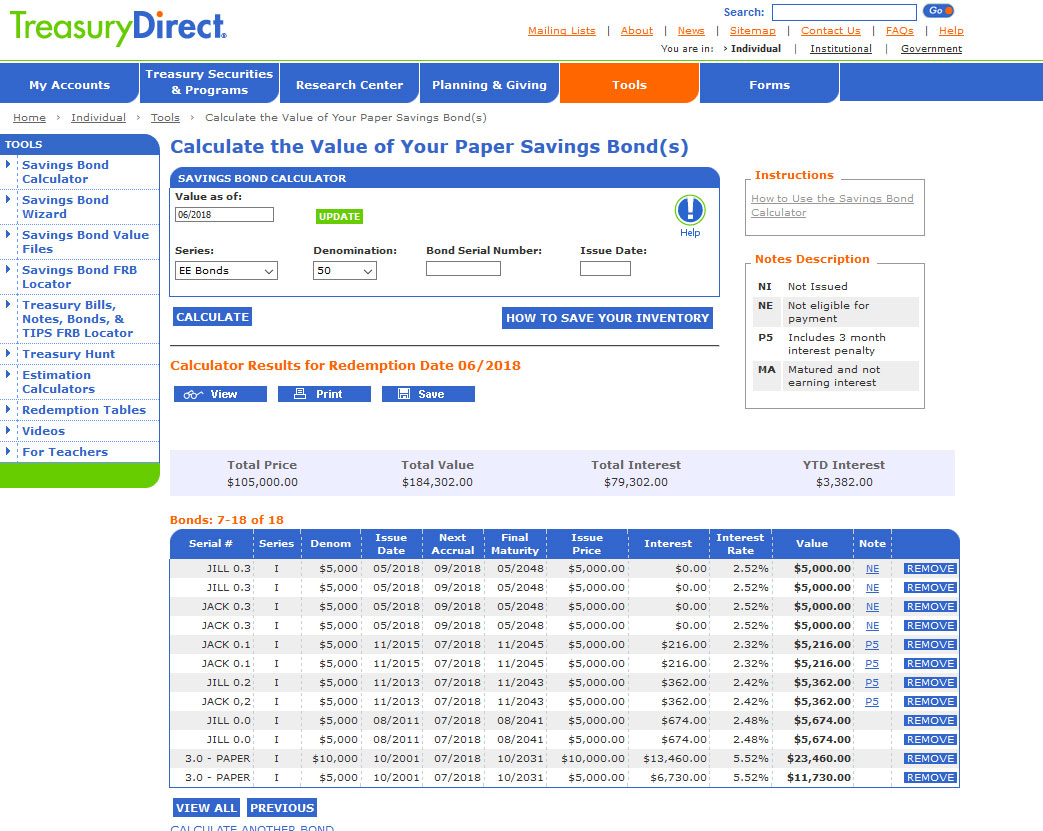

Savings Bond Calculator Treasurydirect

Interactive Brokers Review 2023 Pros And Cons Uncovered

Top 10 Best Sip Mutual Funds To Invest In India In 2018 Basunivesh

Treasury Management Systems Guide 2015 2016 By Bobsguide Issuu

Getting A 7 12 Return With Series I Savings Bonds Route To Retire

Research Center Treasurydirect

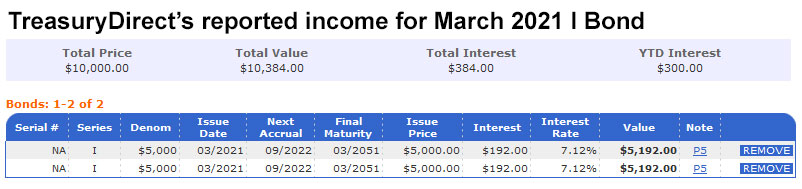

Don T Go Ballistic Over The Way Treasurydirect Reports I Bond Interest Treasury Inflation Protected Securities

How To Calculate Savings Bond Interest 14 Steps With Pictures

How To Check The Value Of Savings Bonds Paper Electronic

How Often Should You Re Balance Your Portfolio Quora

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

Research Center Treasurydirect

Resource Archive Kyriba

Us Treasury Savings Bond Calculator First State Bank

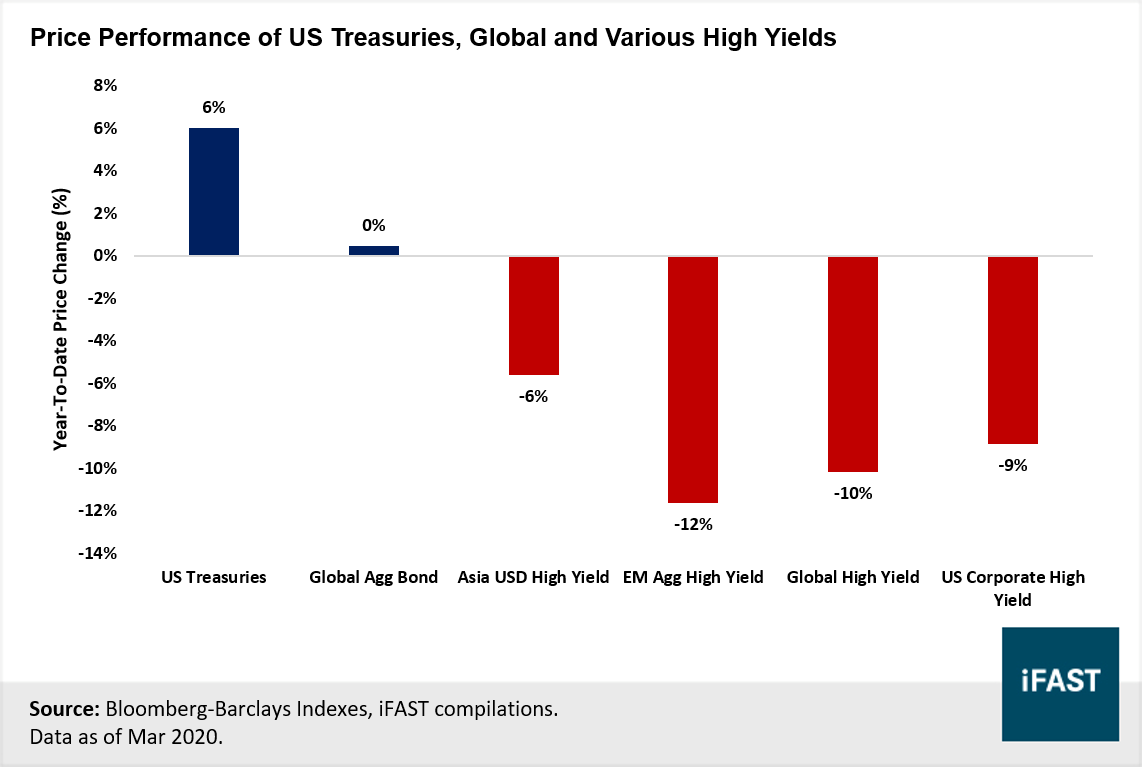

High Yields Bonds Are Cheap After The Massive Sell Off But Are They Worth Buying Now Bondsupermart